Key Takeaways

- Investment banking is evolving with technological advancements and market shifts.

- Career opportunities in investment banking vary widely but often include lucrative salaries.

- Key skills for investment bankers include analytical ability, communication skills, and financial acumen.

- Networking and continuous learning are essential for career growth in investment banking.

Introduction to Investment Banking Careers

Investment banking is a dynamic field that offers numerous career opportunities for those with the right skill set and mindset. The sector has continuously evolved, driven by technological advancements and changing market landscapes. Understanding the current trends and future directions in investment banking can help professionals and aspiring bankers navigate their careers more effectively. For instance, looking into the Goldman Sachs analyst salary structure can provide valuable insights into the financial rewards associated with this career path.

The investment banking industry, known for its high-stakes environment, attracts individuals with a strong educational background and a deep understanding of financial markets. Success in this field requires intellectual capability and the ability to adapt to rapid changes and high pressure.

Trends Shaping the Investment Banking Industry

Several important factors are shaping the future of investment banking. One noteworthy development is the increasing integration of technology into financial services. Blockchain, machine learning, and artificial intelligence are among the technologies that completely change how banks function and provide services to their customers. With the speed and efficiency afforded by these advancements, investment banks can make data-driven decisions more quickly and accurately. According to Forbes, leveraging innovative technology can significantly streamline processes and enhance decision-making capabilities, ultimately driving more effective investment strategies.

Another notable trend is the growing importance of sustainable finance. Investment banks increasingly prioritize investments that offer financial returns and social and environmental benefits. This shift towards sustainability is not just a compliance-driven agenda but also a recognition that sustainable investments can generate long-term value and reduce risks.

Career Opportunities in Investment Banking

Careers in investment banking span a wide range of roles, from entry-level analysts to senior managing directors. Most entry-level positions require a strong educational background in finance, economics, or a related field. Many professionals begin their careers as analysts, gaining crucial hands-on experience in financial modeling, market analysis, and deal structuring. These foundational skills are critical as they provide the technical expertise to succeed in more advanced roles.

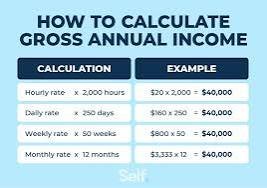

As one progresses in their career, opportunities expand into relationship management, strategy development, and team leadership. Compensation in investment banking is another strong allure. Entry-level analysts often command competitive base salaries complemented by performance bonuses. According to data, salaries in investment banking can be substantial, with significant increases as professionals climb the organizational ladder. For instance, a mid-level associate’s compensation can include a combination of salary, bonuses, and stock options that reflect the value they bring to their firm.

Essential Skills for Success

Individuals need a wide array of skills to excel in investment banking. Strong analytical abilities are crucial for evaluating financial data, identifying market trends, and developing investment strategies. Analytical thinking allows bankers to interpret complex financial reports, understand economic indicators, and make informed client recommendations.

Effective communication skills are equally important. Investment bankers must be able to present their findings and recommendations clearly and persuasively to clients and colleagues. Whether crafting a pitch book, presenting a merger and acquisition (M&A) strategy, or advising on capital raising, the ability to convey complex information in an understandable manner is vital.

Additionally, proficiency in financial software and modeling tools is often required. Excel remains the industry standard for financial modeling, but familiarity with other software like Bloomberg, SQL, and financial databases can set candidates apart. Mastery of these tools enhances accuracy and efficiency in analysis and reporting.

The Role of Networking and Continuous Learning

Networking plays a pivotal role in career progression within investment banking. Building and maintaining relationships with industry professionals can open doors to new opportunities and career advancements. Networking can be effectively achieved by attending industry conferences, joining professional associations, and leveraging social media platforms like LinkedIn. These forums offer opportunities to connect with peers, share insights, and learn from industry leaders.

Mentorship programs also provide invaluable support and guidance for career development. Having a mentor who has navigated the complexities of investment banking can offer practical advice, share experiences, and provide support through challenging periods.

Continuous learning is equally important. Staying updated is crucial given the fast-paced nature of financial markets and frequent regulation updates. Investment bankers must stay well-informed about the latest market trends, regulatory changes, and technological innovations.

Future Directions and Opportunities

The investment banking industry is poised for significant changes in the coming years, driven by both market evolution and technological advancements. Emerging markets and new financial instruments will create fresh growth opportunities. With the growing middle class and increasing financial activities in regions like Asia and Africa, investment banks are exploring these markets for potential investments and business expansions.

Sustainability and ethical investing will likely play more prominent roles as investors increasingly seek companies aligning with their values. This trend is driven by regulatory and compliance requirements and an expanding population of socially conscious investors who value environmental, social, and governance (ESG) criteria in their investment decisions. This approach not only drives positive societal impact but also enhances the long-term value proposition of investments.

Moreover, integrating advanced technologies will continue to reshape the industry landscape. Investment banks that can harness the power of artificial intelligence, machine learning, and big data analytics will have a significant competitive edge. These technologies can improve decision-making processes, enhance risk management, and optimize operations, making investment banking more efficient and effective.

Conclusion: Navigating a Career in Investment Banking

Investment banking offers a challenging yet rewarding career path for individuals prepared to navigate its evolving landscape. By staying informed about industry trends, developing essential skills, and investing in networking and continuous learning, aspiring bankers can position themselves for success. As the industry transforms, those who embrace change and innovation will be well-equipped to thrive in their investment banking careers.