Introduction

Managing personal finances requires a clear understanding of various financial terms and concepts. Two essential terms in this regard are annual income and gross annual income. These concepts are crucial for budgeting, tax filing, and financial planning. To calculate annual income, you can multiply your gross monthly income by 12.

This article provides an in-depth look at annual income, gross annual income, and the methods for calculating them, along with their significance in financial decision-making. Both annual income and net income are crucial metrics for understanding your overall financial health and planning accordingly.

Annual Income Overview

What Is Annual Income?

Annual income refers to the total amount of money an employee earns in a year before any deductions such as taxes, retirement contributions, or other benefits. It includes all forms of earnings, including salaries, wages, bonuses, and other financial benefits.

Monthly vs. Yearly Income

While annual income is the total amount earned in a year, it is usually paid out over 12 months. The payments are typically divided into regular paychecks, such as biweekly or monthly payments. This structure ensures employees receive consistent income throughout the year.

Calculating Annual Income

To calculate annual income, you can use one of the following methods:

- Monthly Income Method: Divide the gross pay (total earnings before deductions) by the number of months worked to determine the monthly income. Multiply the monthly income by 12 to get the annual income. For example, if an employee earns $30,000 in gross income over 5 months, their monthly income is $6,000. Multiplying $6,000 by 12 gives an annual income of $72,000.

- Pay Period Method: Multiply the gross pay for one pay period by the total number of pay periods in a year. For biweekly payments, this is typically 26 pay periods.

Calculating annual income accurately is essential for tax estimation, investment planning, and understanding one’s financial situation. For those uncertain about their calculations, annualizing calculators can provide a helpful shortcut.

Workweeks and Hours

How Many Weeks Per Year Are There?

There are 52 weeks in a year.

How Many Whole Weeks Are in a Year?

On average, each year amounts to 52 weeks and one day, or 52 whole weeks in total.

Typical Working Hours Per Year

A typical full-time employee works 40 hours per week. Given there are 52 weeks in a year, the total working hours per year is 2,080. This figure does not account for paid time off (PTO) and vacation, which vary by employee and organization.

Understanding Compensation

What Does Compensation Mean?

Annual income is a part of an employee’s total compensation package. Compensation refers to the monetary payment employees earn for performing their jobs. It includes salaries, wages, bonuses, and other financial benefits. Compensation is a critical factor in employment decisions, with research showing that 75% of employees would consider leaving their current job for a higher salary.

Components of Total Compensation

Total compensation combines an employee’s annual income with other financial benefits provided during the working period. These benefits may include:

- Commissions and bonuses

- Health and dental insurance

- Disability and life insurance

- Sick leave and paid time off

- Retirement plans

- Tuition and child care assistance

Annual Income vs. Annualized Income

Annual Income

Annual income is the actual total earnings for a year, typically used for salaried employees with predictable annual earnings. Salaried employees receive their pay regardless of the number of hours worked, meaning they usually do not receive overtime and do not have to clock in.

Annualized Income

Annualized income is an estimated annual salary based on the actual time spent on the job and the wage type. It ensures a regular paycheck distribution and helps facilitate tax, insurance premium, and employment benefit payments.

Significance of Annualized Income

Understanding the difference between annual income and annualized income is essential for several reasons:

- Tax Purposes: The IRS considers an employee’s annualized compensation as taxable income, determining how much tax is owed.

- Employer/Employee-Matched Contributions: Certain retirement plans’ contribution limits are based on compensation, not salary.

- Employee Valuation: It helps employers determine if employees are fairly compensated in pay and benefits relative to their skills, capabilities, and experience.

- Budgeting: Annualized salary is often used to budget for full-time employees not working a full year, part-time employees, and hourly workers.

For example, a school teacher who works a 10-month position during the year but receives biweekly pay throughout the year benefits from annualized salary payments. This method ensures regular paychecks, making it easier to manage taxes, insurance, and other employment benefits.

Gross Annual Income

What Is Gross Annual Income?

Gross annual income refers to the total earnings an individual receives in one fiscal year before any deductions. It includes all forms of income, not just from employment but also from other sources such as investments, pensions, and support payments.

Components of Gross Annual Income

Gross annual income can include:

- Wages

- Salary

- Commission

- Overtime pay

- Retirement funds

- Pensions

- Welfare benefits

- Child support payments

- Income from investments

Importance of Knowing Gross Annual Income

Knowing your gross annual income is crucial for making major financial decisions, such as creating a budget, applying for loans or credit cards, and accurately reporting taxes. Loan agencies use this figure to determine borrowing limits and interest rates. Accurate reporting of gross annual income ensures correct tax payments.

AGI vs. Net Annual Income

Annual Gross Income (AGI)

Annual gross income is sometimes confused with net annual income. While AGI is the total earnings before deductions, net annual income is the amount left after deductions.

Example Calculation

For instance, someone with a gross annual income of $100,000 and a tax rate of 25% would have a net annual income of $75,000. It’s crucial to differentiate between these two because budgeting and financial decisions should be based on net income, not gross income, to avoid overspending.

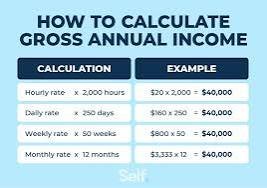

Calculating Gross Annual Income

Steps to Calculate Gross Annual Income

- Determine How You’re Paid

Figure out whether you receive pay by the hour or by the year. If your pay is consistent each time you receive a paycheck, you are likely a salaried employee. If your income fluctuates, you may need a different calculation method.

- Calculate Consistent Payments

For consistent monthly payments, multiply the monthly income by 12 to get the gross annual income. Use the gross income figure before any deductions.

Formulas for different payment measurements include:

- Hourly rate x 2,000

- Daily rate x 250

- Weekly rate x 50

- Calculate Hourly Payments

If your payments vary, use the formula: (Estimated number of hours worked per week) x (hourly rate) x 52 = gross annual income. Adjust the weeks if you work fewer than 52.

Example Calculation

For example, if you work 35 hours per week at $16 per hour, your gross annual income is: 35 x 16 x 52 = $29,120.

- Include All Income Sources

Consider all income sources, including secondary jobs and investments, when calculating gross annual income. Use appropriate formulas for each source.

Net Annual Income

Calculating Net Annual Income

To find net annual income, subtract deductions such as taxes and child support from the gross annual income. Alternatively, calculate net income directly from earnings after deductions.

Converting Net Income to Gross Income

To convert net income to gross income, use the formula: Net income / (1 – deduction rate). For example, if net income is $29,750 and the tax rate is 15%, the gross income is: $29,750 / 0.85 = $35,000.

Frequently Asked Questions

Does Annual Gross Income Include Additional Income?

Yes, annual gross income includes all pre-tax earnings from various sources, including bonuses, commissions, tips, and other compensations. However, some sources, like social security benefits, may be exempt from taxes.

Difference Between Annual Gross Income and Adjusted Gross Income (AGI)

AGI is the gross income after deductions and adjustments. This figure is crucial for determining eligibility for various benefits and tax deductions.

Impact of Annual Gross Income on Credit Score

While annual gross income does not directly affect credit scores, it influences financial stability, payment history, debt-to-income ratio, and credit utilization ratio. Higher income can lead to better creditworthiness.

Conclusion

Understanding annual and gross annual income is vital for financial management, tax filing, and making informed financial decisions. Knowing how to calculate these figures accurately helps in budgeting, applying for loans, and ensuring a stable financial future. By considering all sources of income and understanding the implications of deductions, individuals can better manage their finances and plan for their future needs.